Corporate tax software is designed to simplify and streamline the tax filing process, making it easier for organizations to handle everything from calculating taxes to filing returns and managing tax-related documents. By automating many of these tasks, tax software not only improves efficiency but also helps ensure compliance with ever-evolving regulations.

In this article, we’ll explore some of the top corporate tax software solutions available today. Each of these platforms offers unique features tailored to different needs, from comprehensive tax management to specialized functions like tax planning and compliance.

- ProConnect Tax

- TurboTax Business

- Lacerte Tax

- Sovos

- Abound

- Avalara

- ProSeries Tax

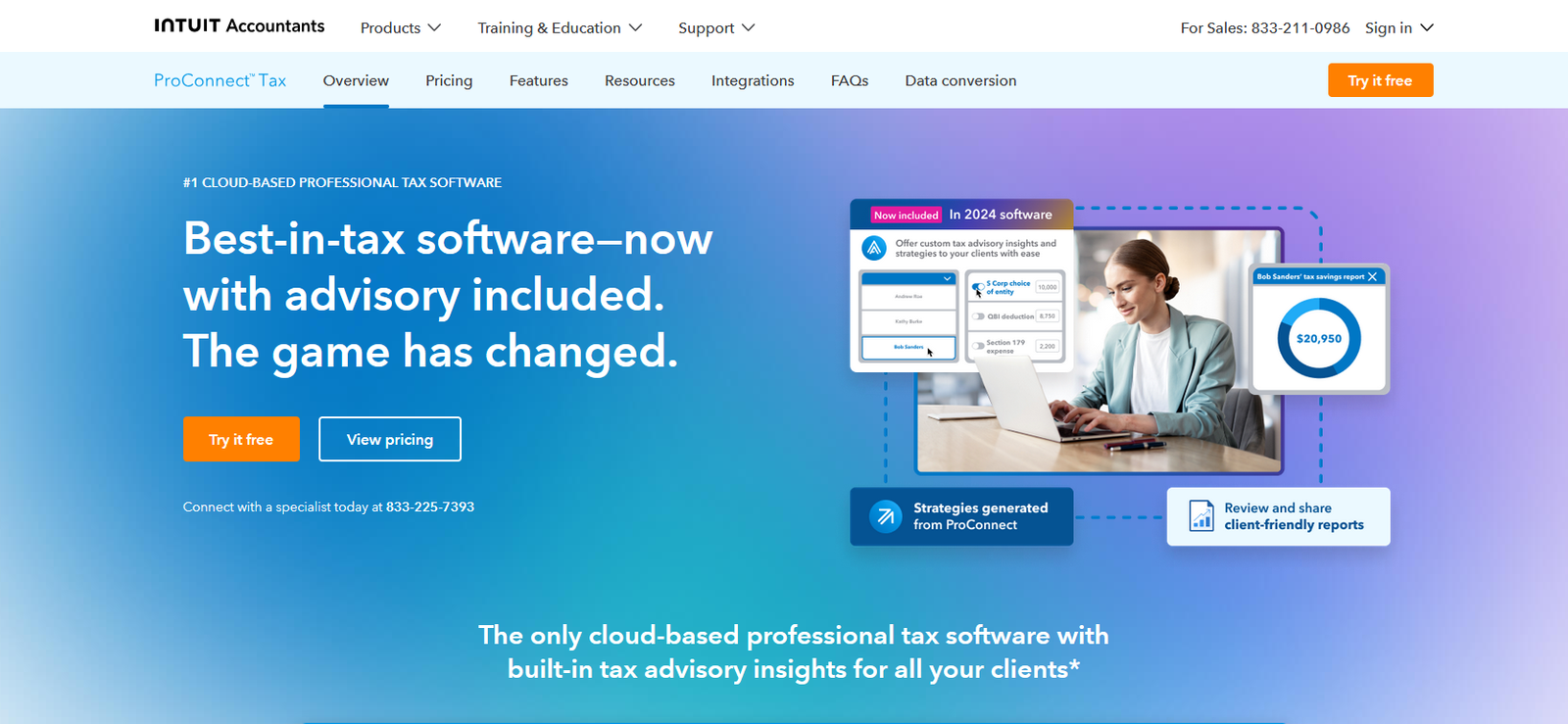

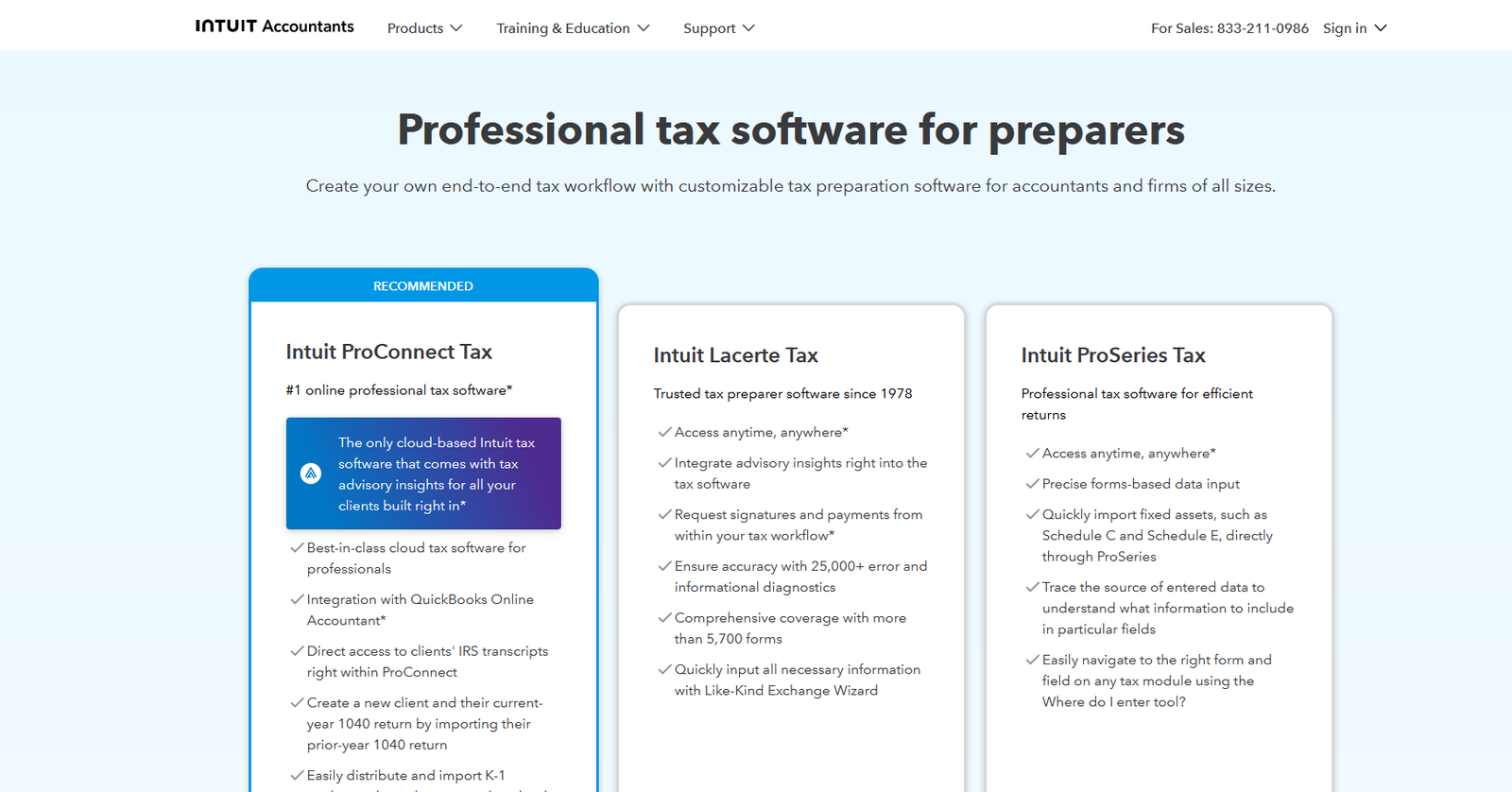

1. ProConnect Tax

ProConnect Tax is a powerful, browser-based tax software solution that caters to the needs of accounting professionals and firms. Designed to streamline the entire tax process—from compliance work to advisory services—ProConnect offers a range of features to enhance productivity and efficiency.

One of the standout features of ProConnect is its ability to handle returns of any complexity level, making it suitable for both small businesses and large enterprises. The software supports unlimited users, allowing staff to collaborate in real-time from any location. This flexibility is particularly beneficial for firms with remote or distributed teams.

ProConnect also integrates seamlessly with a variety of other applications, creating a cohesive ecosystem that enhances overall productivity. By automating compliance tasks and simplifying the tax preparation process, ProConnect enables firms to scale confidently and manage tax responsibilities with ease.

2. TurboTax Business

TurboTax Business offers a user-friendly approach to corporate tax management. Designed for business owners and accountants who may not have extensive knowledge of tax regulations, TurboTax simplifies the tax filing process with its intuitive interface and guided workflows.

The software is tailored to handle the specific needs of small and medium-sized businesses, making it easy to navigate through the complexities of business taxes without requiring in-depth expertise. TurboTax Business provides step-by-step guidance, ensuring that users can accurately complete their tax returns and take advantage of available deductions and credits.

For those who prefer a straightforward, easy-to-use solution, TurboTax Business provides a reliable option for managing corporate tax obligations efficiently.

3. Lacerte Tax

Lacerte Tax is a robust professional tax software solution designed for large tax and accounting firms. Available as both a desktop and hosted application, Lacerte caters to organizations that require advanced tools for handling complex returns and managing multiple preparers.

With its comprehensive feature set, Lacerte provides extensive support for intricate tax scenarios and large-scale tax preparation projects. The software’s capabilities are particularly valuable for firms that need to manage a high volume of returns and require sophisticated tools to handle detailed tax calculations and compliance.

Lacerte’s focus on powerful functionality and scalability makes it an excellent choice for large tax and accounting practices seeking to streamline their operations and enhance their tax management capabilities.

4. Sovos

Sovos offers a modern, IT-driven approach to tax compliance, providing businesses with the confidence needed to navigate a highly regulated environment. Sovos’ cloud-based solutions are designed to be scalable, reliable, and secure, making them suitable for organizations of all sizes.

Sovos’ platform integrates with a wide variety of business applications and government compliance processes, ensuring seamless connectivity and data flow. With over 100,000 customers, including many Fortune 500 companies, Sovos has established itself as a leader in the tax compliance space.

The company’s solutions are designed to address the complexities of global tax regulations, providing a user-friendly experience that helps businesses stay compliant while managing their tax responsibilities efficiently.

5. Abound

Abound provides a modern API solution focused on W-9 collection, TIN verifications, 1099 filings, and other federal and state-level compliance tasks. Abound’s platform is designed to streamline these processes, reducing the administrative burden associated with tax compliance.

The software’s API capabilities allow for seamless integration with existing systems, enabling businesses to automate data collection and verification processes. This automation not only improves accuracy but also enhances overall efficiency by reducing the need for manual intervention.

Abound is particularly useful for organizations that need to manage large volumes of compliance-related tasks and require a streamlined, technology-driven solution to handle these responsibilities.

6. Avalara

Avalara is a leading provider of tax compliance automation software, serving over 30,000 business and government customers across more than 90 countries. Avalara’s solutions are designed to make tax compliance faster, easier, and more accurate.

With over 1,200 signed partner integrations, Avalara’s platform connects with leading ecommerce, ERP, and billing systems to provide comprehensive tax calculations, document management, and return filing capabilities. The software’s extensive integration network ensures that tax data is accurately captured and processed, reducing the risk of errors and improving overall compliance.

Avalara’s focus on automation and integration makes it a valuable tool for businesses looking to enhance their tax compliance processes and manage their tax obligations more effectively.

7. ProSeries Tax

ProSeries Tax is a versatile tax software solution that simplifies the tax preparation process from start to finish. Designed to manage the entire tax lifecycle, ProSeries enables users to collect and import data automatically, file returns efficiently, and ensure accuracy throughout the process.

The software’s user-friendly interface and comprehensive feature set make it suitable for a wide range of tax management needs. ProSeries supports various tax scenarios and provides tools to streamline data collection, calculation, and filing tasks.

For businesses seeking a reliable and efficient solution to manage their tax preparation and filing needs, ProSeries offers a well-rounded option with a focus on automation and ease of use.

Conclusion

Selecting the right corporate tax software is essential for managing tax responsibilities efficiently and ensuring compliance with complex regulations.

Whether you’re looking for a powerful, scalable solution for large firms or a user-friendly option for small businesses, these platforms provide a range of capabilities designed to enhance tax management and streamline the filing process.

By understanding the strengths of each software solution, businesses can make informed choices that align with their specific tax management needs and ensure a smooth and efficient tax compliance experience.