In today’s fast-paced business environment, efficient invoice management is crucial for maintaining healthy cash flow and financial accuracy. Invoice management software helps businesses automate the processes associated with handling invoices, from receipt and approval to payment and storage. By streamlining these tasks, companies can reduce manual errors, accelerate payment cycles, and improve overall financial management.

Here, we explore some of the top invoice management software solutions that cater to various business needs and sizes.

1. Stampli

Stampli is a dedicated finance automation platform with a focus on accounts payable (AP). Unlike other platforms that may prioritize cash flow management, Stampli is designed by AP experts specifically to enhance the efficiency of AP departments.

Key Features:

- AP-Centric Design: Built for AP teams, Stampli covers the entire invoice lifecycle, from vendor onboarding to payment processing.

- Collaboration Tools: Features like invoice chat enable real-time communication between AP teams and other departments.

- Automated Invoice Processing: Stampli uses AI to extract and validate invoice data, streamlining the approval and payment process.

Benefits: Stampli’s AP-first approach ensures that every aspect of invoice management is optimized for efficiency. Its user-friendly interface and collaboration tools make it easier for teams to handle invoices quickly and accurately, reducing administrative burdens and improving financial oversight.

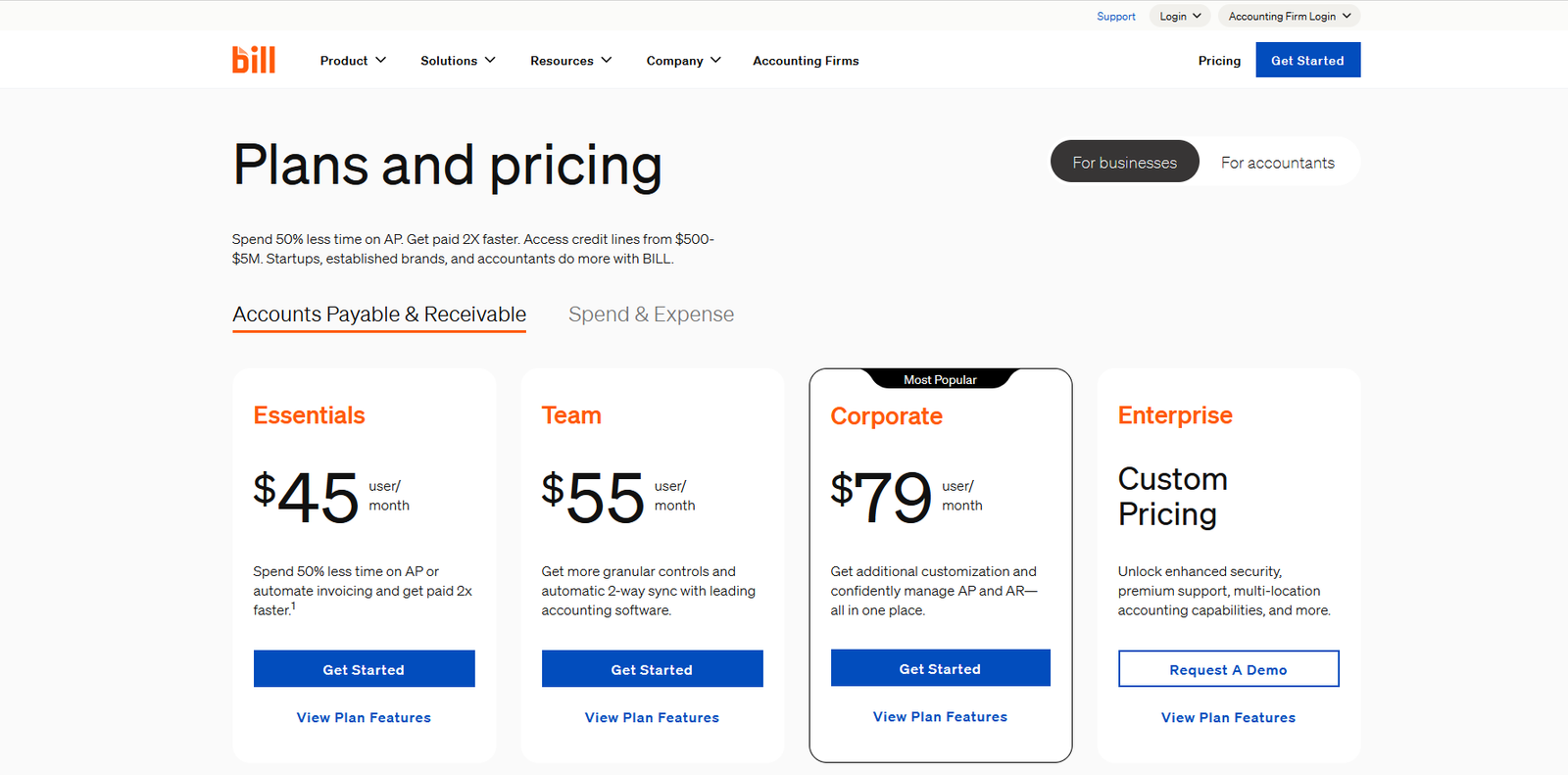

2. BILL AP/AR

BILL (NYSE: BILL) provides a comprehensive financial operations platform tailored for small and midsize businesses (SMBs). It offers automation for accounts payable (AP), accounts receivable (AR), and spend management.

Key Features:

- Integrated Financial Operations: Automates both AP and AR processes, improving control over cash flow.

- Network of Members: BILL’s proprietary network helps businesses process payments faster by connecting with a vast network of financial institutions and partners.

- Expense Management: Streamlines expense reporting and management to reduce administrative overhead.

Benefits: BILL’s integrated platform simplifies financial operations for SMBs, making it easier to manage payables, receivables, and expenses. The platform’s extensive network facilitates quicker payments and receipts, contributing to better cash flow management.

3. SAP Concur

SAP Concur is a leading provider of integrated travel, expense, and invoice management solutions. The platform focuses on automating and simplifying these processes to enhance business efficiency.

Key Features:

- Automated Invoice Approvals: Streamlines the invoice approval process with automated workflows.

- Expense Integration: Integrates travel and expense data into invoice management for a comprehensive view of spending.

- Real-Time Data and AI: Uses AI to audit transactions and provide near real-time insights into spending.

Benefits: SAP Concur’s integration of travel, expense, and invoice management offers a unified solution for financial operations. The use of AI for transaction auditing and real-time data enhances accuracy and visibility, helping businesses manage their spending more effectively.

4. Airbase

Airbase is a modern spend management platform designed for mid-sized to large businesses. It combines accounts payable automation, expense management, and corporate card solutions into a single platform.

Key Features:

- Unified Spend Management: Integrates AP automation, expense management, and corporate cards for a comprehensive financial management solution.

- Guided Procurement: Streamlines the purchase process with approval workflows and budget controls.

- Integration with General Ledgers: Seamlessly connects with popular general ledgers like NetSuite and Sage Intacct.

Benefits: Airbase’s all-in-one approach to spend management simplifies complex financial processes, making it easier to control spending and manage financial risk. Its integration capabilities and guided procurement features ensure efficient financial operations and enhanced compliance.

5. SAP S/4HANA Cloud

SAP S/4HANA Cloud is a modular cloud ERP solution powered by AI and analytics. It offers a real-time, integrated approach to managing various business functions, including invoicing.

Key Features:

- Real-Time Operations: Enables businesses to run mission-critical operations in real-time, enhancing agility and responsiveness.

- Modular Design: Offers a range of modules that can be customized to meet specific business needs.

- Global Expansion: Supports global business operations with features for multi-currency and multi-language requirements.

Benefits: SAP S/4HANA Cloud’s real-time capabilities and modular design make it a versatile solution for businesses of all sizes. Its integration of AI and analytics provides valuable insights and improves decision-making, while its global capabilities support international operations.

6. Xero

Xero is a popular cloud-based accounting platform with a strong focus on small businesses. It provides a comprehensive suite of tools for managing accounting, payroll, expenses, and invoicing.

Key Features:

- Core Accounting: Includes features for invoicing, expense tracking, and financial reporting.

- Connected Ecosystem: Offers integration with a wide range of apps and financial institutions.

- Single Accounting Ledger: Provides a unified ledger for managing client accounts and compliance.

Benefits: Xero’s comprehensive suite of accounting tools and extensive ecosystem of connected apps make it an ideal choice for small businesses. Its user-friendly interface and integration capabilities streamline financial management and improve efficiency.

Conclusion

Effective invoice management is essential for maintaining smooth financial operations and ensuring timely payments. The right invoice management software can significantly enhance the efficiency of your accounts payable and receivable processes, reduce manual errors, and improve cash flow management.

From dedicated AP platforms like Stampli to comprehensive solutions like SAP Concur and Airbase, there are various options available to meet different business needs. Whether you’re a small business looking for integrated financial operations or a larger enterprise needing real-time ERP capabilities, selecting the right software can streamline your invoice management and contribute to overall financial health.

Evaluate your specific requirements, such as the need for automation, integration with existing systems, or global support, to choose the software that best aligns with your business objectives. By leveraging these advanced tools, you can optimize your financial workflows and focus more on growing your business.

Pingback: Top 7 Invoicing And Billing Software of 2024 - TopatTop.com