Accounts payable (AP) automation software has emerged as a game-changer for managing large volumes of invoices and financial transactions. This software is designed to streamline the AP process, reduce manual work, and minimize human errors, allowing companies to focus on growth and strategic initiatives. While many accounting solutions offer AP features, they often fall short when dealing with complex AP processes.

Here, we explore some of the top AP automation software solutions available, each offering unique capabilities to enhance your financial operations.

- BILL

- Sage Intacct

- Stampli

- Airbase

- SAP Concur

- Tipalti

- Ramp

- Laserfiche

1. BILL

BILL stands out as a leading financial operations platform tailored for small and midsize businesses (SMBs). Headquartered in San Jose, California, BILL is a champion of SMBs, providing an integrated platform that simplifies the management of payables, receivables, and expense management.

With BILL, businesses can efficiently control their financial operations and benefit from a proprietary network that connects millions of users. This network enables faster payments and receipts, fostering smoother financial transactions.

BILL’s platform is a trusted partner of major U.S. financial institutions and accounting firms, making it a reliable choice for businesses looking to automate their financial operations.

2. Sage Intacct

Sage Intacct is a flexible and scalable financial platform offering comprehensive accounting capabilities. It caters to a wide range of industries and provides core accounting applications, including general ledger, accounts payable, accounts receivable, and cash management.

Sage Intacct’s robust features extend to real-time reporting, time and expense management, project accounting, and global consolidations. This software is particularly beneficial for industries such as nonprofit, healthcare, and professional services, thanks to its specialized functionalities.

Sage Intacct supports diverse business needs, making it a versatile choice for organizations looking to enhance their accounting processes.

3. Stampli

Stampli differentiates itself as the only finance automation platform focused exclusively on accounts payable. Built by AP experts, Stampli excels in driving efficiency across the entire invoice lifecycle.

Its standout feature is Billy the Bot™, an AI-driven tool that automates manual activities and centralizes all invoice-related communication, documentation, and workflows into a single view. Since its debut in 2015, Billy the Bot has saved millions of hours for Stampli customers by processing over $85 billion in invoices annually.

This seamless integration with ERPs from Microsoft, Oracle, Sage, SAP, and others ensures that it adapts to various finance processes and ERP configurations, offering rapid implementation and ease of use.

4. Airbase

Airbase is a modern spend management platform designed for businesses with 100-5,000 employees. It combines accounts payable automation, expense management, and corporate cards into a cohesive package.

Airbase is known for its user-friendly interface and powerful features that facilitate spend control, faster financial close, and risk management. It integrates seamlessly with popular general ledgers like NetSuite and Sage Intacct, making it a versatile solution for businesses.

Airbase’s guided procurement process simplifies purchasing from initial requests to payment and reconciliation, enhancing efficiency and compliance across the organization.

5. SAP Concur

SAP Concur is a leading provider of integrated travel, expense, and invoice management solutions. It aims to simplify and automate these everyday processes, offering a top-rated app that guides employees through travel and expense reporting.

SAP Concur uses AI to audit transactions in near real-time, providing businesses with clear insights into their spending and eliminating budget blind spots. By automating invoice approvals and expense reporting, SAP Concur helps businesses eliminate tedious tasks and run their operations more effectively.

6. Tipalti

Tipalti specializes in automating the end-to-end payables process, including global partner payments and procurement. It promises to eliminate up to 80% of manual workload, providing instant reconciliation with integrations to ERP systems such as NetSuite, QuickBooks, Xero, and Sage Intacct.

Tipalti’s high customer satisfaction rate and its partnerships with fast-growing companies like Amazon Twitch and GoPro underscore its effectiveness. The platform is designed to streamline complex AP processes, making it an ideal choice for businesses seeking to enhance their financial operations.

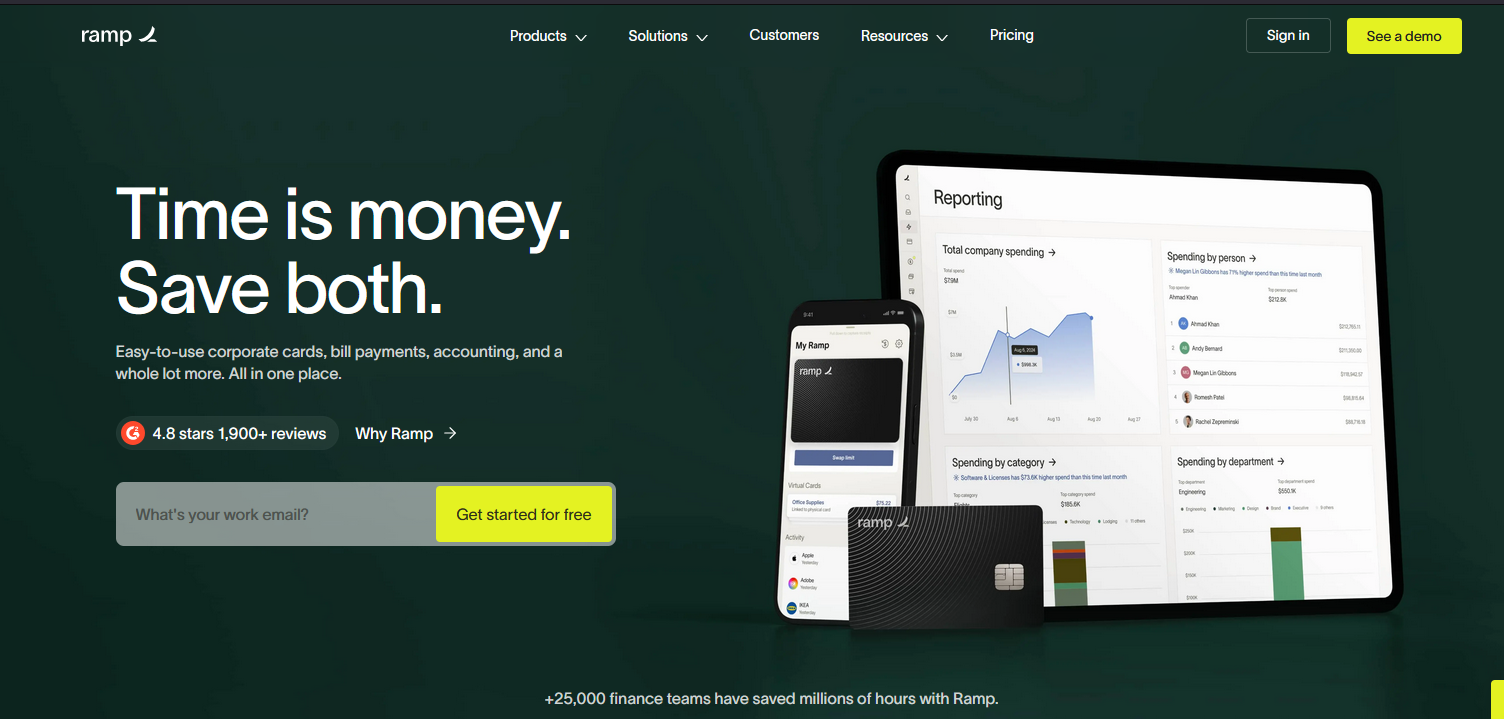

7. Ramp

Ramp is an all-in-one platform for modern finance teams, offering corporate cards, expense management software, bill payments, and vendor management in a single package.

Ramp’s software is designed to automate financial operations and improve business health. Over 20,000 businesses, including Shopify and Glossier, have switched to Ramp to save an average of 5% more and close their books eight times faster.

Ramp’s comprehensive approach to spend management, including support for multi-subsidiaries and multi-currency transactions, makes it a valuable tool for businesses with complex financial needs.

8. Laserfiche

Laserfiche is a leading SaaS provider of enterprise content management (ECM) and business process automation. With over 30 years of experience in pioneering paperless offices, Laserfiche offers powerful workflows, electronic forms, document management, and analytics to accelerate business processes.

Its innovative use of cloud technology, machine learning, and AI helps organizations in over 80 countries transform into digital businesses. Laserfiche’s solutions are designed to enhance efficiency and streamline business operations, making it a strong contender in the field of AP automation.

Conclusion

The landscape of accounts payable automation software is rich with diverse solutions tailored to various business needs.

Choosing the right AP automation software depends on your organization’s size, industry, and specific needs. By leveraging these advanced tools, businesses can reduce manual work, minimize errors, and enhance their overall financial operations, paving the way for greater efficiency and strategic growth.